Invoicing for General Contractors Made Easy - The Payment Platform Built for General Contractors

Build stronger cash flow with payments that actually work for general contracting businesses

Trusted by 10,000+ industrial small businesses

Why General Contractors Are Switching to Nickel

Unlike traditional payment processors that treat you like a "high-risk" business, Nickel was built specifically for trade professionals who handle large invoice-based transactions. We understand that:

- $150,000 commercial construction project payments are normal business, not suspicious activity

- Multi-phase billing creates payment surges throughout project lifecycles that banks often flag as unusual

- You need reliable processing during peak construction seasons when cash flow is most critical

- Your cash flow depends on predictable payment timing from both clients and to subcontractors, not arbitrary holds that can paralyze your entire operation

Result: No surprise account holds, no "business verification" delays, no risk department calls that can freeze your working capital when you need it most.

Why General Contractors Are Switching to Nickel

Unlike traditional payment processors that treat you like a "high-risk" business, Nickel was built specifically for trade professionals who handle large invoice-based transactions. We understand that:

- $150,000 commercial construction project payments are normal business, not suspicious activity

- Multi-phase billing creates payment surges throughout project lifecycles that banks often flag as unusual

- You need reliable processing during peak construction seasons when cash flow is most critical

- Your cash flow depends on predictable payment timing from both clients and to subcontractors, not arbitrary holds that can paralyze your entire operation

Result: No surprise account holds, no "business verification" delays, no risk department calls that can freeze your working capital when you need it most.

Before Nickel vs. After Nickel

Multiple systems for invoicing, payments, and bookkeeping

Banks freeze accounts over routine $150,000 commercial project payments

Lose 1-3% on every transaction ($1,500-4,500 per major project)

Banks don't understand general contracting business patterns

Hours spent matching payments to invoices in QuickBooks

Everything integrated: invoicing, payments, and QuickBooks sync

We understand large and variable transactions are normal for general contractors and our support team is highly responsive if you ever run into issues

Keep 100% of what customers pay you

Designed around how your business actually works

Your invoices and payments automatically sync to the right customer, project, and job, plus seamless AP integration

The Modern General Contractor Payment Crisis

The general contracting industry faces a complex web of financial challenges that generic payment processors simply don't understand. With over 35,000 general contractors managing projects in a $2.2 trillion construction market, contractors are caught between demanding clients, complex subcontractor payment schedules, and banks that don't understand construction cash flow patterns.

Multi-Tier Payment Complexity:

General contractors operate as the financial hub of construction projects, collecting payments from property owners while simultaneously managing payments to multiple subcontractors, suppliers, and vendors. A typical commercial project might involve 15-25 different payment relationships, from electrical and plumbing subs to material suppliers and equipment rentals. Each relationship has different payment terms, creating a complex cash flow puzzle that traditional banks see as high-risk activity rather than standard business operations.

Extended Payment Cycles with Immediate Obligations:

While general contractors often face 30-60 day payment terms from clients, they're responsible for meeting weekly payroll, paying subcontractors on completion milestones, and covering material deliveries immediately upon receipt. Recent industry data shows that subcontractors wait an average of 56 days for payment, while general contractors believe they're paying in 30 days. This disconnect creates constant pressure to finance the gap between project expenses and client payments.

Retainage and Progress Payment Challenges:

Construction projects typically involve retainage - withholding 5-10% of payments until project completion - which can tie up hundreds of thousands of dollars for months or even years. A $2 million commercial project with 10% retainage means $200,000 in earned revenue sitting in escrow while the contractor still faces full material and labor costs. When banks see large, irregular payments followed by months of smaller progress payments, they often interpret this as suspicious rather than standard construction billing practices.

Subcontractor Management and Cash Flow:

With 84% of construction businesses struggling with cash flow issues, general contractors face intense pressure from subcontractors for faster payment while waiting for their own collections. The industry's common "pay-when-paid" terms create cascading delays where tier-two and tier-three subs might wait 90+ days for payment. This creates relationship strain and can impact future project availability when subs choose to work with contractors offering better payment terms.

The Modern General Contractor Payment Crisis

The general contracting industry faces a complex web of financial challenges that generic payment processors simply don't understand. With over 35,000 general contractors managing projects in a $2.2 trillion construction market, contractors are caught between demanding clients, complex subcontractor payment schedules, and banks that don't understand construction cash flow patterns.

Multi-Tier Payment Complexity:

General contractors operate as the financial hub of construction projects, collecting payments from property owners while simultaneously managing payments to multiple subcontractors, suppliers, and vendors. A typical commercial project might involve 15-25 different payment relationships, from electrical and plumbing subs to material suppliers and equipment rentals. Each relationship has different payment terms, creating a complex cash flow puzzle that traditional banks see as high-risk activity rather than standard business operations.

Extended Payment Cycles with Immediate Obligations:

While general contractors often face 30-60 day payment terms from clients, they're responsible for meeting weekly payroll, paying subcontractors on completion milestones, and covering material deliveries immediately upon receipt. Recent industry data shows that subcontractors wait an average of 56 days for payment, while general contractors believe they're paying in 30 days. This disconnect creates constant pressure to finance the gap between project expenses and client payments.

Retainage and Progress Payment Challenges:

Construction projects typically involve retainage - withholding 5-10% of payments until project completion - which can tie up hundreds of thousands of dollars for months or even years. A $2 million commercial project with 10% retainage means $200,000 in earned revenue sitting in escrow while the contractor still faces full material and labor costs. When banks see large, irregular payments followed by months of smaller progress payments, they often interpret this as suspicious rather than standard construction billing practices.

Subcontractor Management and Cash Flow:

With 84% of construction businesses struggling with cash flow issues, general contractors face intense pressure from subcontractors for faster payment while waiting for their own collections. The industry's common "pay-when-paid" terms create cascading delays where tier-two and tier-three subs might wait 90+ days for payment. This creates relationship strain and can impact future project availability when subs choose to work with contractors offering better payment terms.

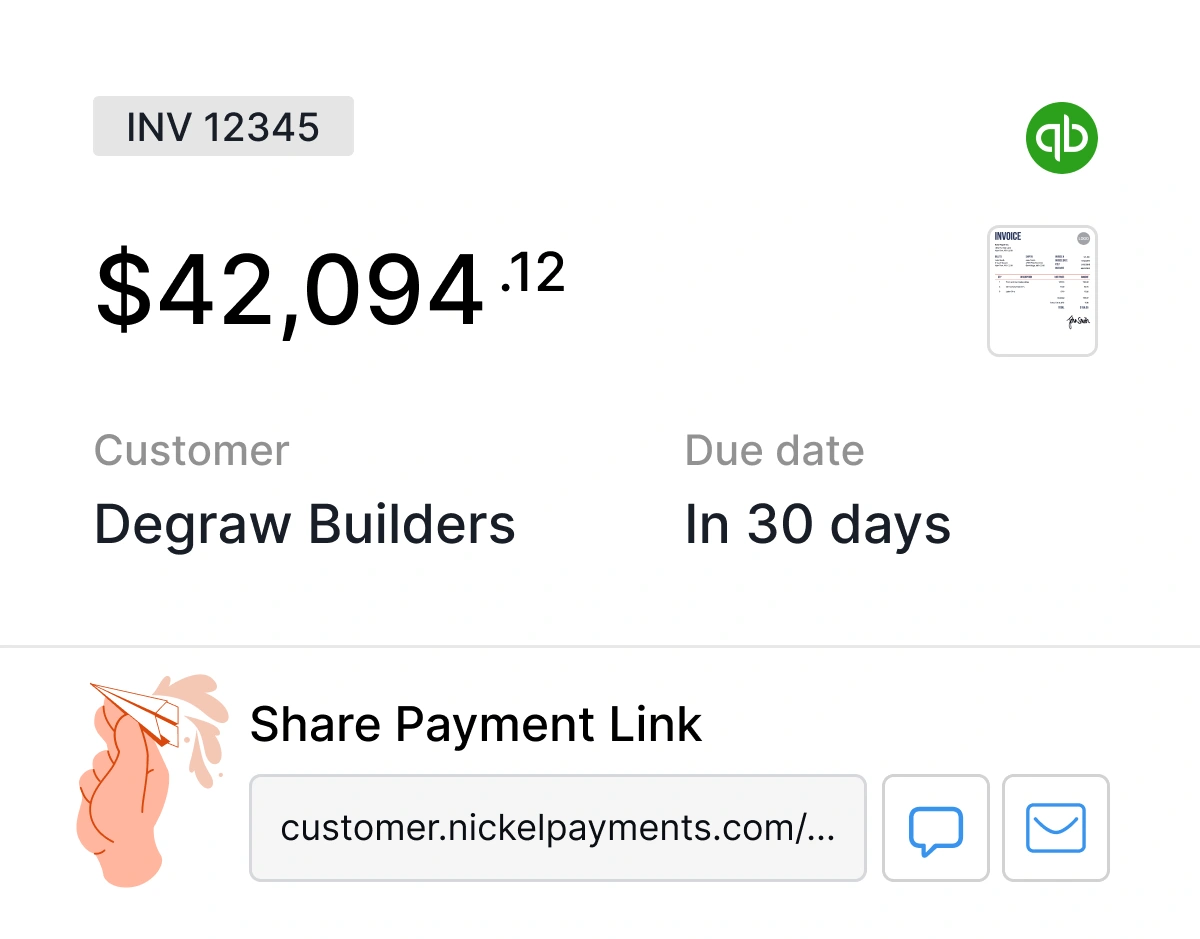

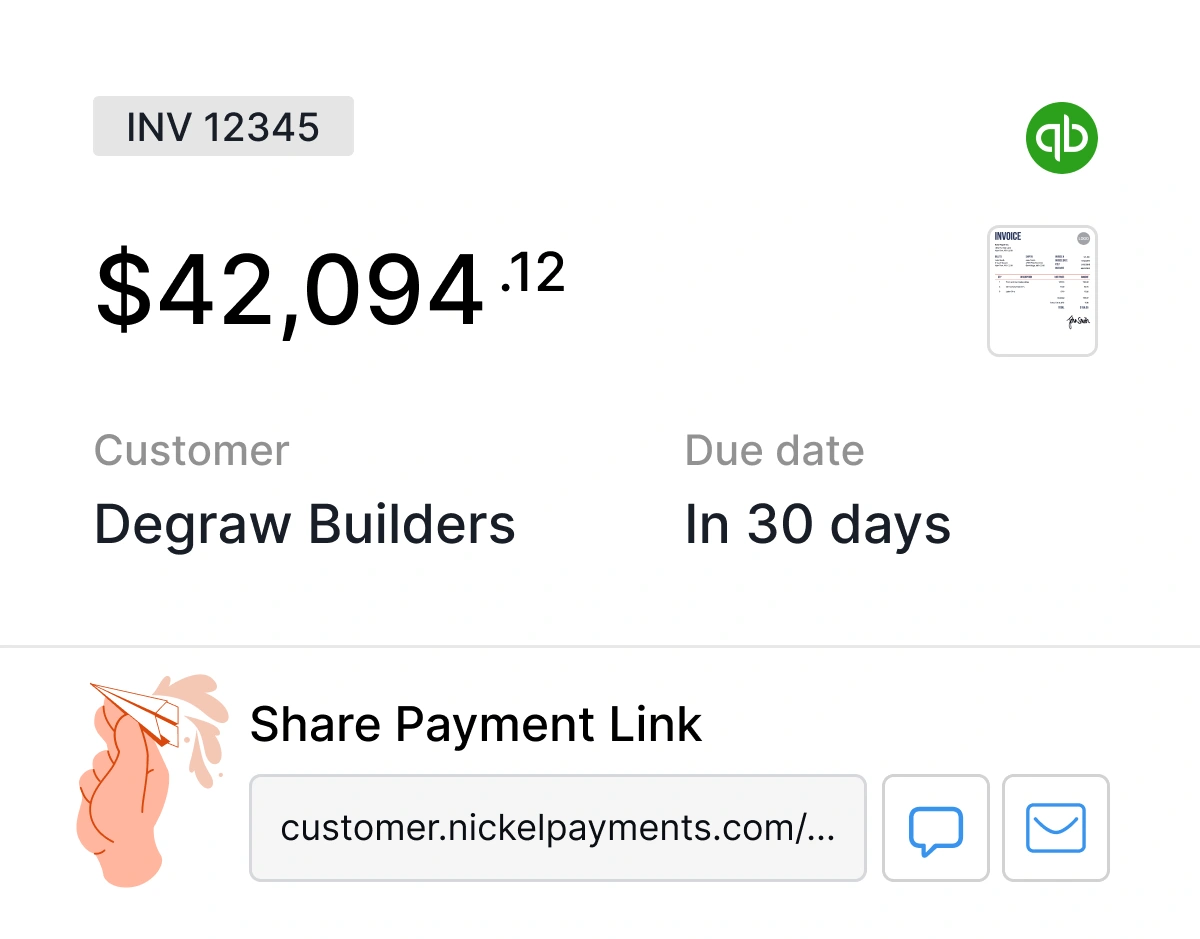

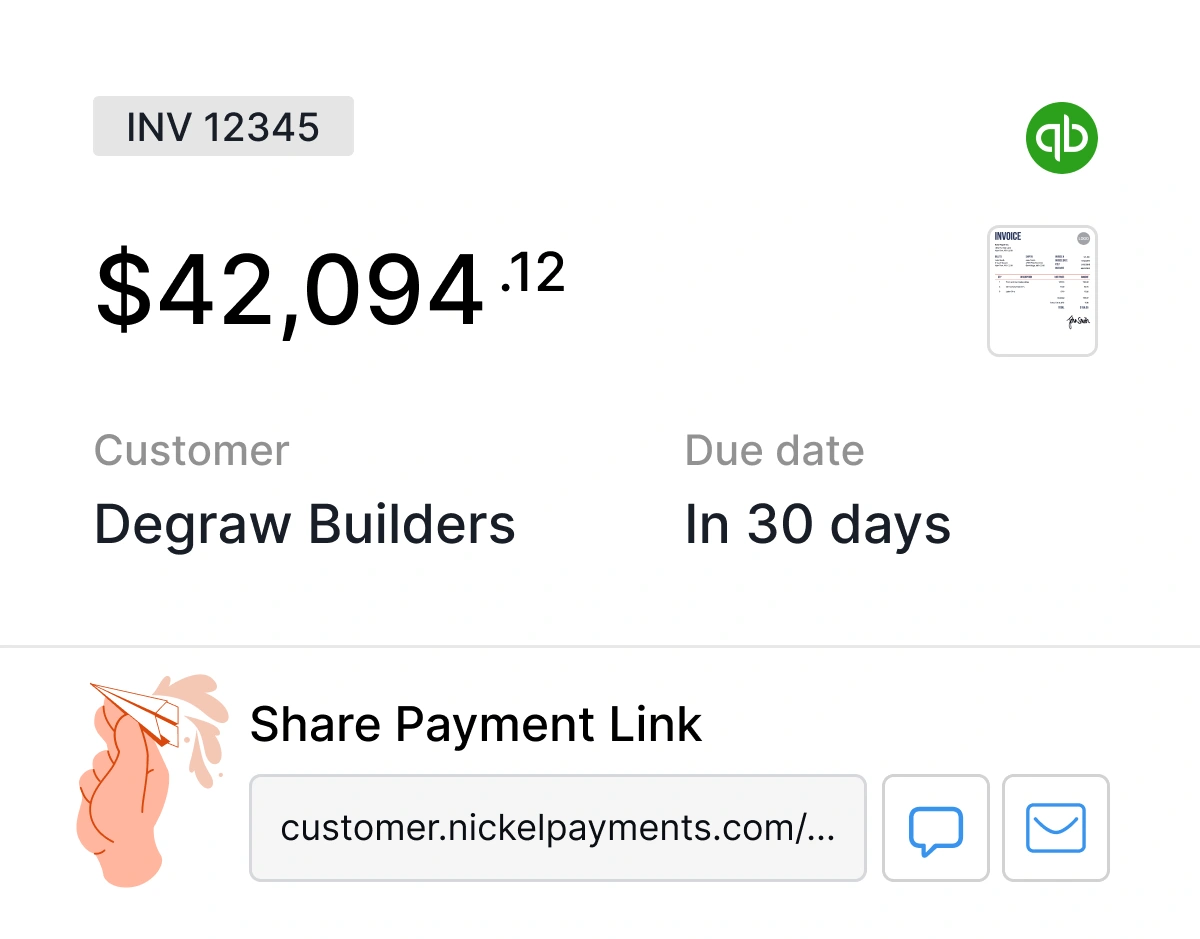

Simplified Modern Workflow

Send invoice (or use your existing invoicing)

Customer pays instantly via secure link

Payment auto-syncs to QuickBooks

Money hits your account in 2 business days

Built-in QuickBooks Integration

Your payments automatically sync to the right invoice, customer, and job. No more:

Compare: Nickel vs. Other Payment Platforms

What This Means for Your General Contracting Business

Save Money

Zero ACH fees: Save $15,000-45,000 per year on a typical general contracting business No hidden costs: No setup fees, monthly fees, or surprise charges Early payment discounts: Pay and get paid faster, capture supplier discounts

Save Time

Automated reconciliation: 3+ hours per week saved on bookkeeping Instant invoicing: Send payment links directly from job sites One system: Stop switching between payment apps, banking apps, and QuickBooks

Reduce Risk

Process large payments worry-free: We understand general contracting transactions and provide responsive support when needed Predictable processing: Money hits your account in 2 business days Secure payments: Bank-level security without the bank headaches

General Contracting Industry Payment Breakdown

The $2.2 trillion U.S. construction industry faces unique financial pressures that traditional payment processors weren't designed to handle, with general contractors at the center of the most complex payment challenges.

Market Scale and Complexity:

With over 745,000 construction businesses in the United States and 8.2 million construction employees, the industry represents one of the largest sectors of the American economy. General contractors manage the financial coordination of this massive ecosystem, often handling project values ranging from $100,000 residential renovations to $50 million+ commercial developments. The average general contractor coordinates payments across 10-30 different vendors per project, creating cash flow complexity that far exceeds most other industries.

Payment Term Economics:

Industry surveys reveal that while most construction companies offer payment terms of 30 days or less, less than 40% actually get paid within 30 days. General contractors face this delay from clients while being responsible for immediate payments to subcontractors, suppliers, and weekly employee payroll. A typical $500,000 commercial project might involve $300,000 in subcontractor payments and $150,000 in materials - all requiring payment before the contractor receives their final payment from the client.

Subcontractor Payment Challenges:

The construction industry's multi-tier payment structure creates cascading financial pressure. General contractors often work under "pay-when-paid" agreements with property owners, then must manage similar terms with their subcontractors. However, recent data shows that 40% of subcontractors retain 50-100% of their profits in the business just to fund operations while waiting for payment. This cash crunch among subcontractors creates pressure on general contractors to offer faster payment terms to secure quality trades for future projects.

Technology and Efficiency Gaps:

Despite managing billions in transactions, many general contractors still rely on manual processes for payment management. The industry has been slow to adopt digital payment solutions, with many contractors still using checks for subcontractor payments and manual reconciliation for project accounting. This creates opportunities for efficiency gains through automated payment processing, digital invoicing, and integrated accounting systems that can reduce administrative overhead while improving cash flow visibility across multiple concurrent projects.

General Contracting Industry Payment Breakdown

The $2.2 trillion U.S. construction industry faces unique financial pressures that traditional payment processors weren't designed to handle, with general contractors at the center of the most complex payment challenges.

Market Scale and Complexity:

With over 745,000 construction businesses in the United States and 8.2 million construction employees, the industry represents one of the largest sectors of the American economy. General contractors manage the financial coordination of this massive ecosystem, often handling project values ranging from $100,000 residential renovations to $50 million+ commercial developments. The average general contractor coordinates payments across 10-30 different vendors per project, creating cash flow complexity that far exceeds most other industries.

Payment Term Economics:

Industry surveys reveal that while most construction companies offer payment terms of 30 days or less, less than 40% actually get paid within 30 days. General contractors face this delay from clients while being responsible for immediate payments to subcontractors, suppliers, and weekly employee payroll. A typical $500,000 commercial project might involve $300,000 in subcontractor payments and $150,000 in materials - all requiring payment before the contractor receives their final payment from the client.

Subcontractor Payment Challenges:

The construction industry's multi-tier payment structure creates cascading financial pressure. General contractors often work under "pay-when-paid" agreements with property owners, then must manage similar terms with their subcontractors. However, recent data shows that 40% of subcontractors retain 50-100% of their profits in the business just to fund operations while waiting for payment. This cash crunch among subcontractors creates pressure on general contractors to offer faster payment terms to secure quality trades for future projects.

Technology and Efficiency Gaps:

Despite managing billions in transactions, many general contractors still rely on manual processes for payment management. The industry has been slow to adopt digital payment solutions, with many contractors still using checks for subcontractor payments and manual reconciliation for project accounting. This creates opportunities for efficiency gains through automated payment processing, digital invoicing, and integrated accounting systems that can reduce administrative overhead while improving cash flow visibility across multiple concurrent projects.

Ranked #1 Easiest to Use Payment Solution by G2

See why Nickel outranks every major competitor, including Forwardly, Melio, and Square

Get Started in Minutes

No contracts. No setup fees. No risk.

Sign Up (2 minutes)

Connect QuickBooks (1 click)

Start Getting Paid (immediately)

Ready to Fix Your Payment Problems?

Stop losing money to fees and time to complicated workflows. Join thousands of contractors who've already made the switch.