The Payment Platform Built for Glaziers

Crystal clear cash flow with payments that actually work for glass and glazing professionals

Trusted by 10,000+ industrial small businesses

Why Glaziers Are Switching to Nickel

Unlike traditional payment processors that treat you like a "high-risk" business, Nickel was built specifically for contractors who handle large invoice-based transactions. We understand that:

- $45,000 curtain wall installations are normal business operations, not suspicious activity

- Commercial project timelines create payment surges that banks often flag as unusual

- You need reliable processing during peak construction seasons without account interference

- Your cash flow depends on predictable payment timing, not arbitrary risk department reviews

Result: No surprise account holds, no "business verification" delays, no risk department calls.

Why Glaziers Are Switching to Nickel

Unlike traditional payment processors that treat you like a "high-risk" business, Nickel was built specifically for contractors who handle large invoice-based transactions. We understand that:

- $45,000 curtain wall installations are normal business operations, not suspicious activity

- Commercial project timelines create payment surges that banks often flag as unusual

- You need reliable processing during peak construction seasons without account interference

- Your cash flow depends on predictable payment timing, not arbitrary risk department reviews

Result: No surprise account holds, no "business verification" delays, no risk department calls.

Before Nickel vs. After Nickel

Multiple systems for invoicing, payments, and bookkeeping

Banks freeze accounts over routine $45,000 curtain wall payments

Lose 1-3% on every transaction ($450-1,350 per commercial job)

Banks don't understand glazing business patterns

Hours spent matching payments to invoices in QuickBooks

Everything integrated: invoicing, payments, and QuickBooks sync

We understand large and variable transactions are normal for glaziers and our support team is highly responsive if you ever run into issues

Keep 100% of what customers pay you

Designed around how your business actually works

Your invoices and payments automatically sync to the right customer, project, and job cost code, plus seamless AP integration

The Payment Crisis Crushing Glass Contractors

The $24 billion glass and glazing industry faces unique payment challenges that generic processors simply don't understand. With office building construction struggling and contractors pivoting to retrofitting and energy efficiency projects, glaziers must adapt to changing market dynamics while maintaining healthy cash flow.

Project Payment Complexity:

Glazing projects often involve milestone-based payments tied to specific installation phases. A commercial curtain wall project might require $25,000 for material ordering, $50,000 at rough-in, and $35,000 upon completion. Traditional banks view these large, irregular payments as red flags, triggering account reviews right when contractors need cash flow most for glass orders and specialized equipment payments.

Material and Equipment Cost Pressure:

Glass fabrication requires substantial upfront investment in specialized materials and equipment. Custom glazing for a single commercial project can cost $75,000-150,000 in materials alone, while specialized installation equipment like vacuum lifts and glass handlers can exceed $50,000. Contractors often finance these purchases while waiting 30-90 days for project payments from general contractors.

Seasonal Construction Cycles:

Glazing work follows commercial construction patterns, with peak activity concentrated in spring through fall when weather permits exterior installations. Winter months often slow dramatically, yet equipment financing, insurance, and shop overhead continue. This seasonal revenue pattern confuses traditional banks, leading to unnecessary scrutiny during peak earning periods.

Insurance and Bonding Requirements:

Glass contractors face higher insurance costs due to the inherent risks of handling large, expensive glass panels at elevation. Professional liability, general liability, and specialized glazing insurance can exceed $15,000-25,000 annually. Many commercial projects also require performance bonds, adding another layer of financial complexity that affects cash flow timing.

The Payment Crisis Crushing Glass Contractors

The $24 billion glass and glazing industry faces unique payment challenges that generic processors simply don't understand. With office building construction struggling and contractors pivoting to retrofitting and energy efficiency projects, glaziers must adapt to changing market dynamics while maintaining healthy cash flow.

Project Payment Complexity:

Glazing projects often involve milestone-based payments tied to specific installation phases. A commercial curtain wall project might require $25,000 for material ordering, $50,000 at rough-in, and $35,000 upon completion. Traditional banks view these large, irregular payments as red flags, triggering account reviews right when contractors need cash flow most for glass orders and specialized equipment payments.

Material and Equipment Cost Pressure:

Glass fabrication requires substantial upfront investment in specialized materials and equipment. Custom glazing for a single commercial project can cost $75,000-150,000 in materials alone, while specialized installation equipment like vacuum lifts and glass handlers can exceed $50,000. Contractors often finance these purchases while waiting 30-90 days for project payments from general contractors.

Seasonal Construction Cycles:

Glazing work follows commercial construction patterns, with peak activity concentrated in spring through fall when weather permits exterior installations. Winter months often slow dramatically, yet equipment financing, insurance, and shop overhead continue. This seasonal revenue pattern confuses traditional banks, leading to unnecessary scrutiny during peak earning periods.

Insurance and Bonding Requirements:

Glass contractors face higher insurance costs due to the inherent risks of handling large, expensive glass panels at elevation. Professional liability, general liability, and specialized glazing insurance can exceed $15,000-25,000 annually. Many commercial projects also require performance bonds, adding another layer of financial complexity that affects cash flow timing.

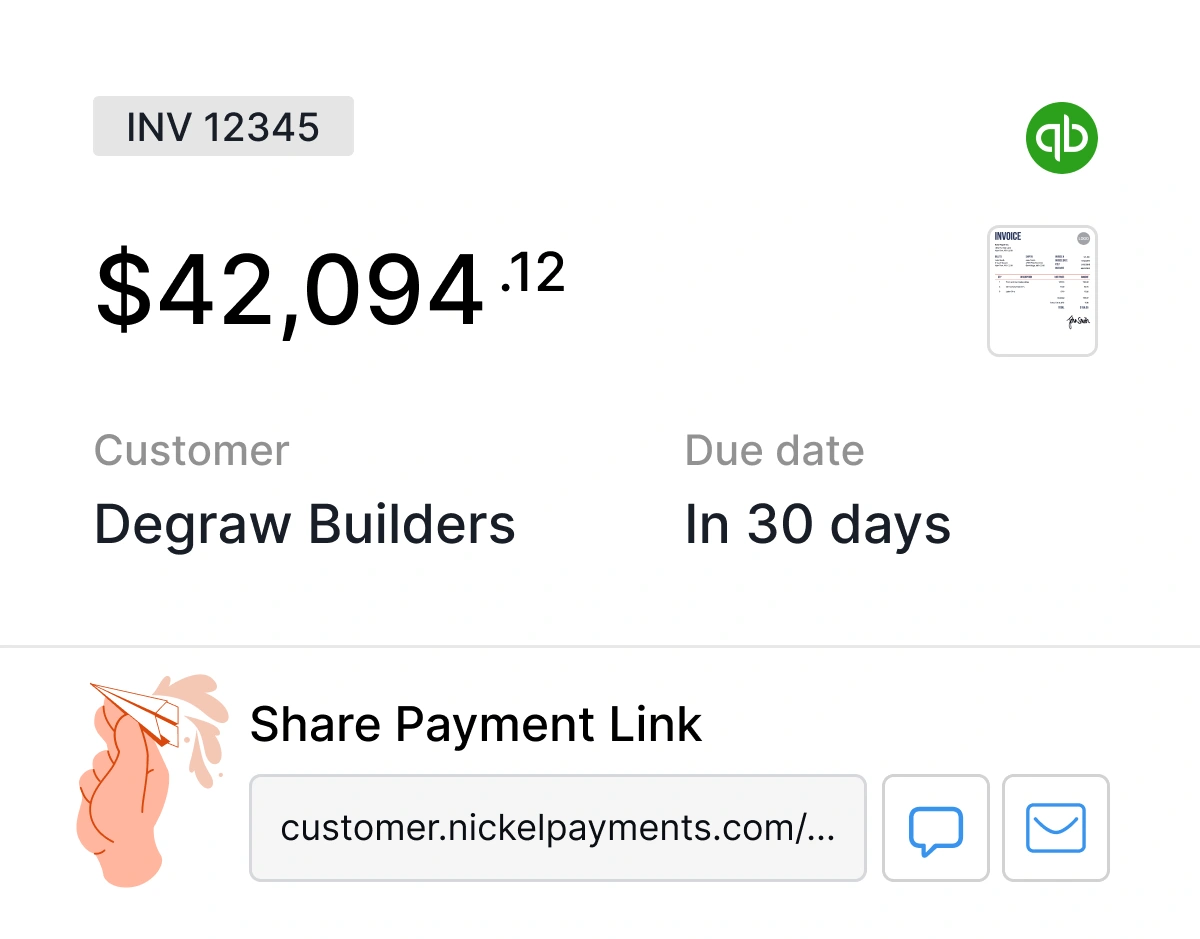

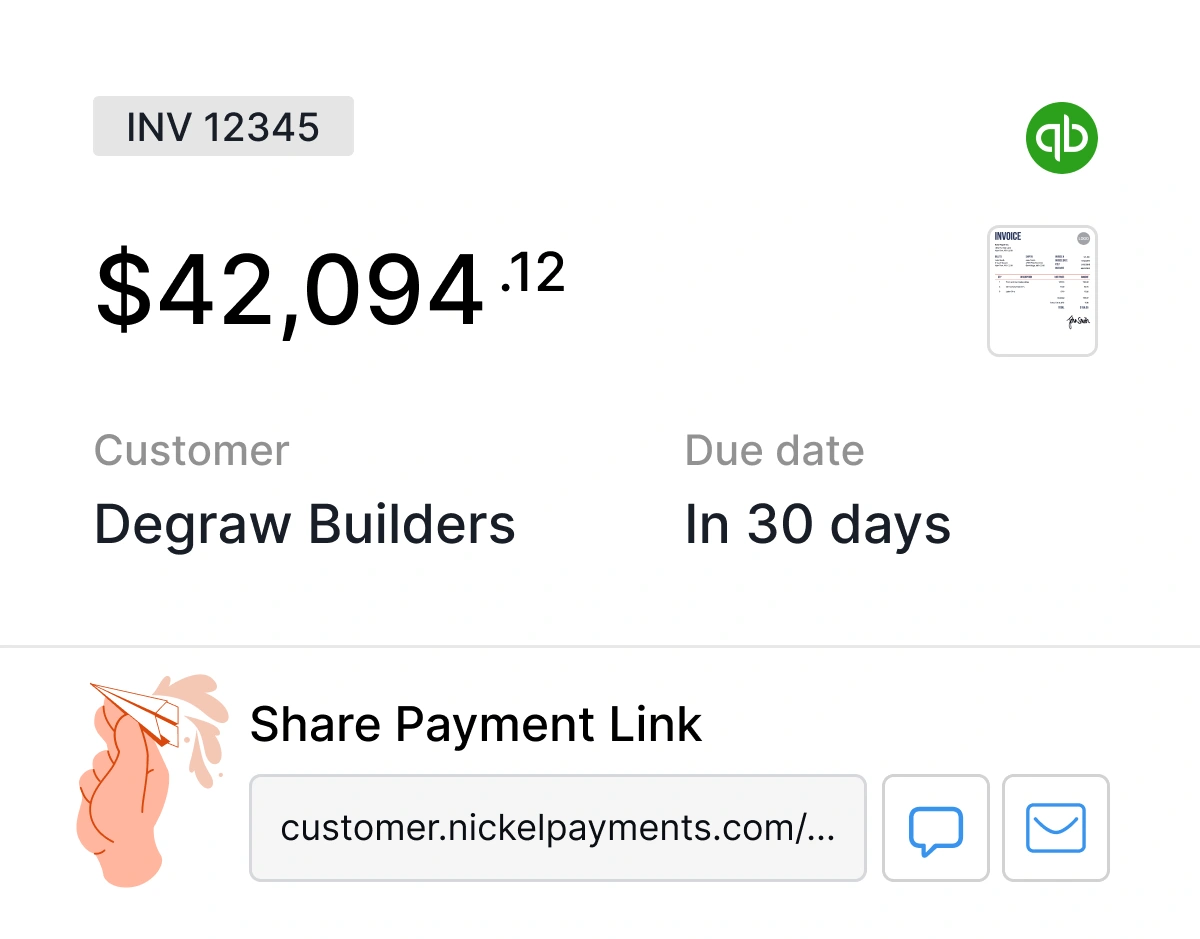

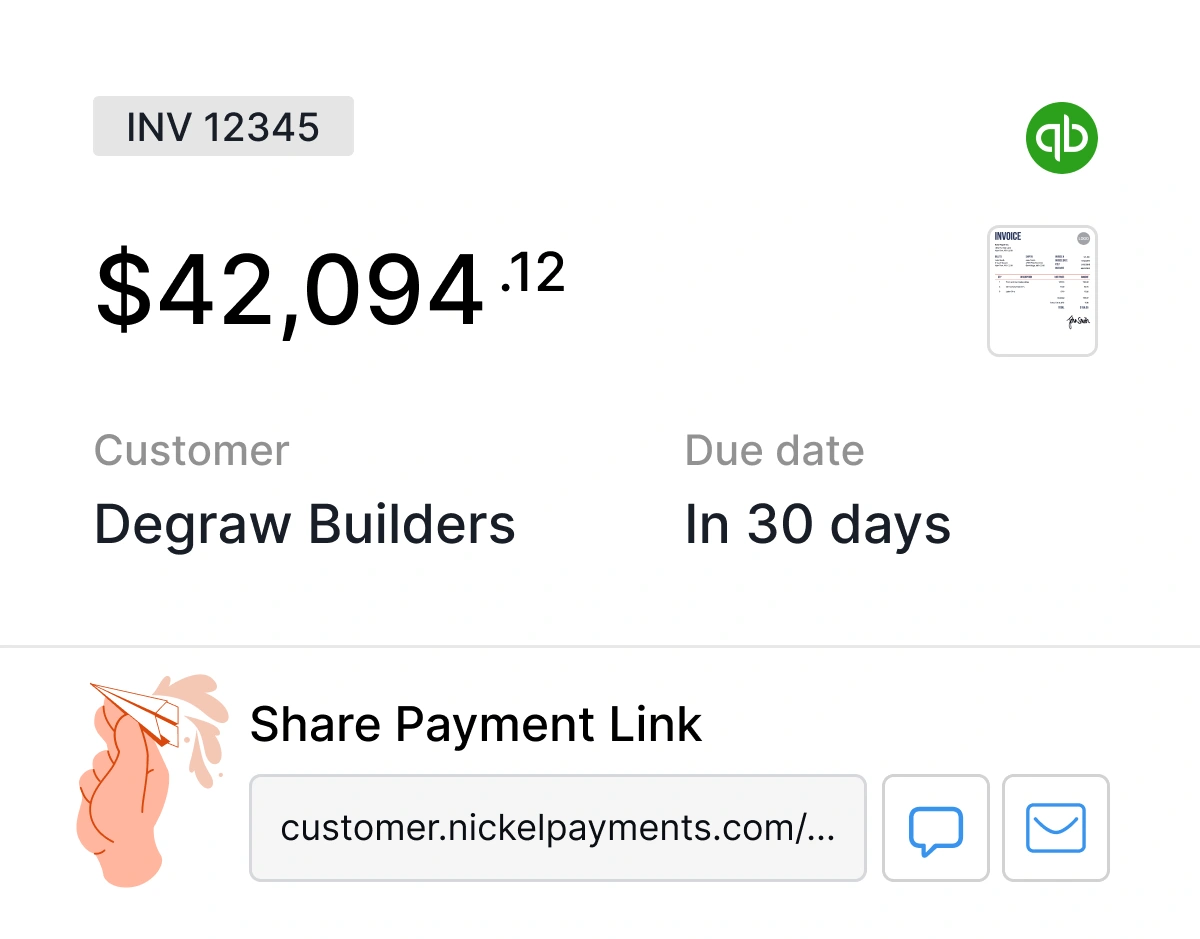

Simplified Modern Workflow

Send invoice (or use your existing invoicing)

Customer pays instantly via secure link

Payment auto-syncs to QuickBooks

Money hits your account in 2 business days

Built-in QuickBooks Integration

Your payments automatically sync to the right invoice, customer, and job. No more:

Compare: Nickel vs. Other Payment Platforms

What This Means for Your Glazing Business

Save Money

Zero ACH fees: Save $8,000-15,000 per year on a typical glazing operation No hidden costs: No setup fees, monthly fees, or surprise charges Early payment discounts: Pay and get paid faster, capture supplier discounts

Save Time

Automated reconciliation: 3+ hours per week saved on bookkeeping Instant invoicing: Send payment links directly from job sites One system: Stop switching between payment apps, banking apps, and QuickBooks

Reduce Risk

Process large payments worry-free: We understand glazing transactions and provide responsive support when needed Predictable processing: Money hits your account in 2 business days Secure payments: Bank-level security without the bank headaches

Glass and Glazing Industry Payment Breakdown

The U.S. glass and glazing industry generates $24 billion annually through thousands of contractors specializing in everything from storefront installations to high-rise curtain walls, yet faces unique financial pressures that traditional payment processors weren't designed to handle.

Market Specialization:

Glass contractors operate in highly specialized niches - curtain wall installation, decorative glass work, energy-efficient retrofits, and commercial storefronts. Each specialty requires different equipment, insurance coverage, and payment structures. A storefront glazier might handle $15,000-25,000 projects regularly, while curtain wall contractors manage $100,000-500,000+ installations. This payment range variation often triggers bank scrutiny despite being normal business operations.

Project-Based Cash Flow Cycles:

Unlike service-based contractors, glaziers often work on extended commercial projects with complex payment schedules. General contractors typically pay in phases - material approval, delivery, rough installation, and final completion. Each phase might involve 30-60 day payment terms, creating cash flow gaps while glaziers carry substantial material and labor costs. The specialized nature of commercial construction means delays cascade through the payment chain.

Equipment and Insurance Burden:

Professional glazing requires specialized equipment that represents significant capital investment. Vacuum glass lifts cost $25,000-40,000, while custom fabrication equipment can exceed $100,000. Monthly equipment financing often runs $5,000-15,000, due regardless of project payment timing. Additionally, glazing contractors carry specialized insurance for glass handling and installation work at elevation, with annual premiums often exceeding $10,000-20,000 for comprehensive coverage.

Quality and Warranty Considerations:

Glass installations carry extended warranty periods, often 5-10 years for commercial work. This creates potential warranty holdbacks and service obligations that affect cash flow. When payment processing fees eat into already thin margins (typically 8-15% on glazing projects), contractors need every available cost advantage to maintain profitability while honoring long-term warranty commitments.

Glass and Glazing Industry Payment Breakdown

The U.S. glass and glazing industry generates $24 billion annually through thousands of contractors specializing in everything from storefront installations to high-rise curtain walls, yet faces unique financial pressures that traditional payment processors weren't designed to handle.

Market Specialization:

Glass contractors operate in highly specialized niches - curtain wall installation, decorative glass work, energy-efficient retrofits, and commercial storefronts. Each specialty requires different equipment, insurance coverage, and payment structures. A storefront glazier might handle $15,000-25,000 projects regularly, while curtain wall contractors manage $100,000-500,000+ installations. This payment range variation often triggers bank scrutiny despite being normal business operations.

Project-Based Cash Flow Cycles:

Unlike service-based contractors, glaziers often work on extended commercial projects with complex payment schedules. General contractors typically pay in phases - material approval, delivery, rough installation, and final completion. Each phase might involve 30-60 day payment terms, creating cash flow gaps while glaziers carry substantial material and labor costs. The specialized nature of commercial construction means delays cascade through the payment chain.

Equipment and Insurance Burden:

Professional glazing requires specialized equipment that represents significant capital investment. Vacuum glass lifts cost $25,000-40,000, while custom fabrication equipment can exceed $100,000. Monthly equipment financing often runs $5,000-15,000, due regardless of project payment timing. Additionally, glazing contractors carry specialized insurance for glass handling and installation work at elevation, with annual premiums often exceeding $10,000-20,000 for comprehensive coverage.

Quality and Warranty Considerations:

Glass installations carry extended warranty periods, often 5-10 years for commercial work. This creates potential warranty holdbacks and service obligations that affect cash flow. When payment processing fees eat into already thin margins (typically 8-15% on glazing projects), contractors need every available cost advantage to maintain profitability while honoring long-term warranty commitments.

Ranked #1 Easiest to Use Payment Solution by G2

See why Nickel outranks every major competitor, including Forwardly, Melio, and Square

Get Started in Minutes

No contracts. No setup fees. No risk.

Sign Up (2 minutes)

Connect QuickBooks (1 click)

Start Getting Paid (immediately)

Ready to Fix Your Payment Problems?

Stop losing money to fees and time to complicated workflows. Join thousands of contractors who've already made the switch.