The Payment Platform Built for Masons

Build strong cash flow foundations with payments that actually work for masonry professionals

Trusted by 10,000+ industrial small businesses

Why Masons Are Switching to Nickel

Unlike traditional payment processors that treat you like a "high-risk" business, Nickel was built specifically for trade professionals who handle large invoice-based transactions. We understand that:

- $40,000 commercial brick and stone projects are normal business, not suspicious activity

- Seasonal construction cycles create payment surges that banks often flag as unusual

- You need reliable processing during peak building seasons and restoration projects

- Your cash flow depends on predictable payment timing, not arbitrary holds

Result: No surprise account holds, no "business verification" delays, no risk department calls.

Why Masons Are Switching to Nickel

Unlike traditional payment processors that treat you like a "high-risk" business, Nickel was built specifically for trade professionals who handle large invoice-based transactions. We understand that:

- $40,000 commercial brick and stone projects are normal business, not suspicious activity

- Seasonal construction cycles create payment surges that banks often flag as unusual

- You need reliable processing during peak building seasons and restoration projects

- Your cash flow depends on predictable payment timing, not arbitrary holds

Result: No surprise account holds, no "business verification" delays, no risk department calls.

Before Nickel vs. After Nickel

Multiple systems for invoicing, payments, and bookkeeping

Banks freeze accounts over routine $40,000 commercial masonry jobs

Lose 1-3% on every transaction ($400-1,200 per typical job)

Banks don't understand masonry business patterns

Hours spent matching payments to invoices in QuickBooks

Everything integrated: invoicing, payments, and QuickBooks sync

We understand large and variable transactions are normal for masons and our support team is highly responsive if you ever run into issues

Keep 100% of what customers pay you

Designed around how your business actually works

Your invoices and payments automatically sync to the right customer, service call, and project, plus seamless AP integration

The Payment Delays Crushing Masonry Contractors

The $32.9 billion masonry contracting industry faces unique financial pressures that generic payment processors simply don't understand. With revenue declining at a 2.7% annual rate over the past five years while material costs continue climbing, masons are caught between shrinking margins and increasingly demanding payment terms from general contractors.

Pay-When-Paid Contract Structures:

Most masonry subcontractors work under "pay-when-paid" or "pay-if-paid" arrangements, meaning they don't receive payment until the general contractor gets paid by the property owner. This creates payment cycles of 60-120 days or longer, forcing masons to finance their customers' projects while covering payroll, material costs, and equipment expenses out of pocket.

Material Cost and Supply Chain Pressures:

Brick, stone, concrete blocks, and mortar have experienced significant price volatility due to supply chain disruptions and raw material shortages. A typical commercial masonry project might require $15,000-30,000 in materials that must be purchased Net 30 from suppliers, but customer payments often take 90+ days. This timing mismatch creates crushing cash flow gaps for small contractors.

Weather-Dependent Work Schedules:

Masonry work is heavily weather-dependent - you can't lay brick or stone in freezing temperatures or during heavy rain. These weather delays create unpredictable work schedules that make cash flow planning nearly impossible. When winter weather pushes your projects back weeks, you're still responsible for payroll, insurance, and equipment payments without incoming revenue.

Specialized Labor and Equipment Costs:

Skilled masons command higher wages due to labor shortages in the industry - the median annual wage for masonry workers is $56,600 according to the Bureau of Labor Statistics. Specialized equipment like mortar mixers, scaffolding systems, and cutting tools require significant capital investment. When customer payments are delayed, meeting payroll and equipment financing becomes a constant struggle.

The Payment Delays Crushing Masonry Contractors

The $32.9 billion masonry contracting industry faces unique financial pressures that generic payment processors simply don't understand. With revenue declining at a 2.7% annual rate over the past five years while material costs continue climbing, masons are caught between shrinking margins and increasingly demanding payment terms from general contractors.

Pay-When-Paid Contract Structures:

Most masonry subcontractors work under "pay-when-paid" or "pay-if-paid" arrangements, meaning they don't receive payment until the general contractor gets paid by the property owner. This creates payment cycles of 60-120 days or longer, forcing masons to finance their customers' projects while covering payroll, material costs, and equipment expenses out of pocket.

Material Cost and Supply Chain Pressures:

Brick, stone, concrete blocks, and mortar have experienced significant price volatility due to supply chain disruptions and raw material shortages. A typical commercial masonry project might require $15,000-30,000 in materials that must be purchased Net 30 from suppliers, but customer payments often take 90+ days. This timing mismatch creates crushing cash flow gaps for small contractors.

Weather-Dependent Work Schedules:

Masonry work is heavily weather-dependent - you can't lay brick or stone in freezing temperatures or during heavy rain. These weather delays create unpredictable work schedules that make cash flow planning nearly impossible. When winter weather pushes your projects back weeks, you're still responsible for payroll, insurance, and equipment payments without incoming revenue.

Specialized Labor and Equipment Costs:

Skilled masons command higher wages due to labor shortages in the industry - the median annual wage for masonry workers is $56,600 according to the Bureau of Labor Statistics. Specialized equipment like mortar mixers, scaffolding systems, and cutting tools require significant capital investment. When customer payments are delayed, meeting payroll and equipment financing becomes a constant struggle.

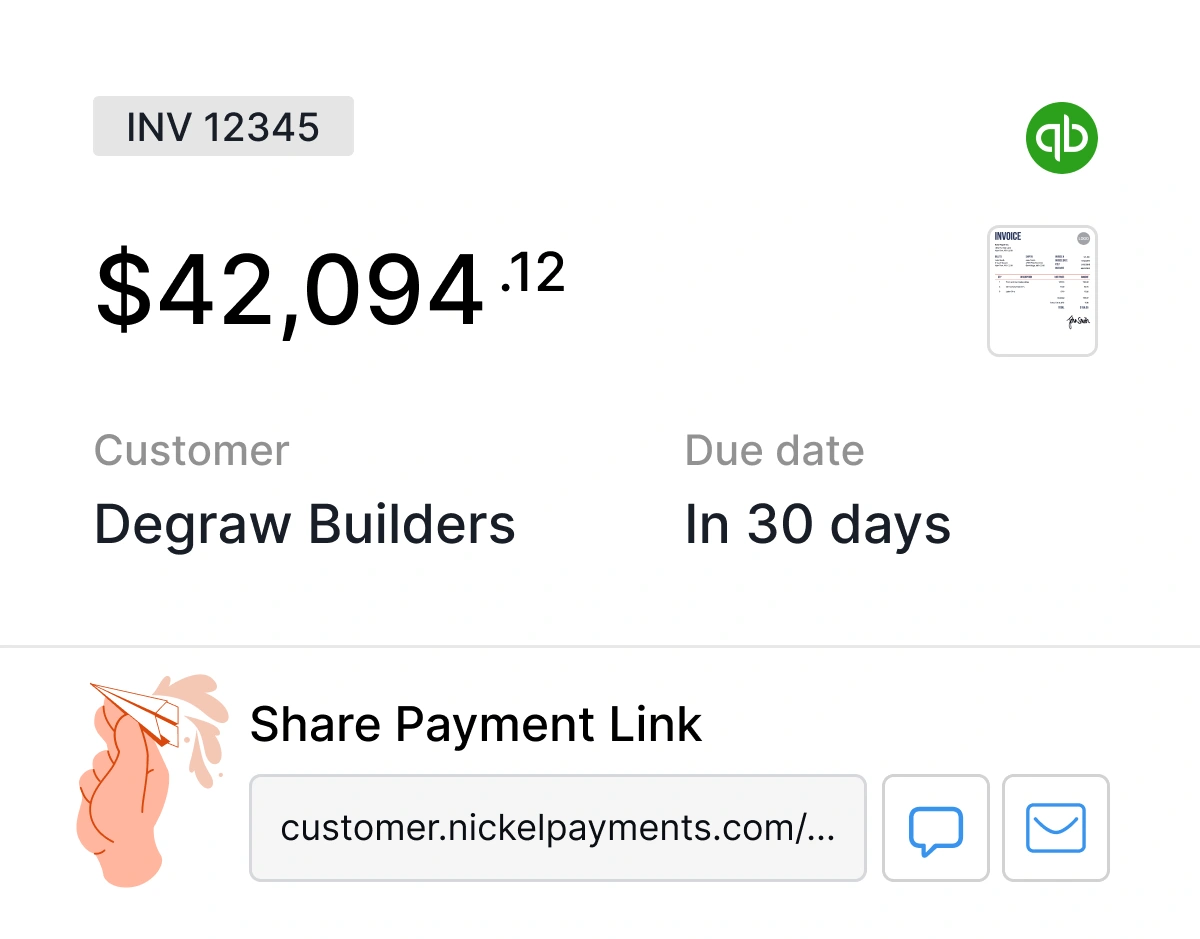

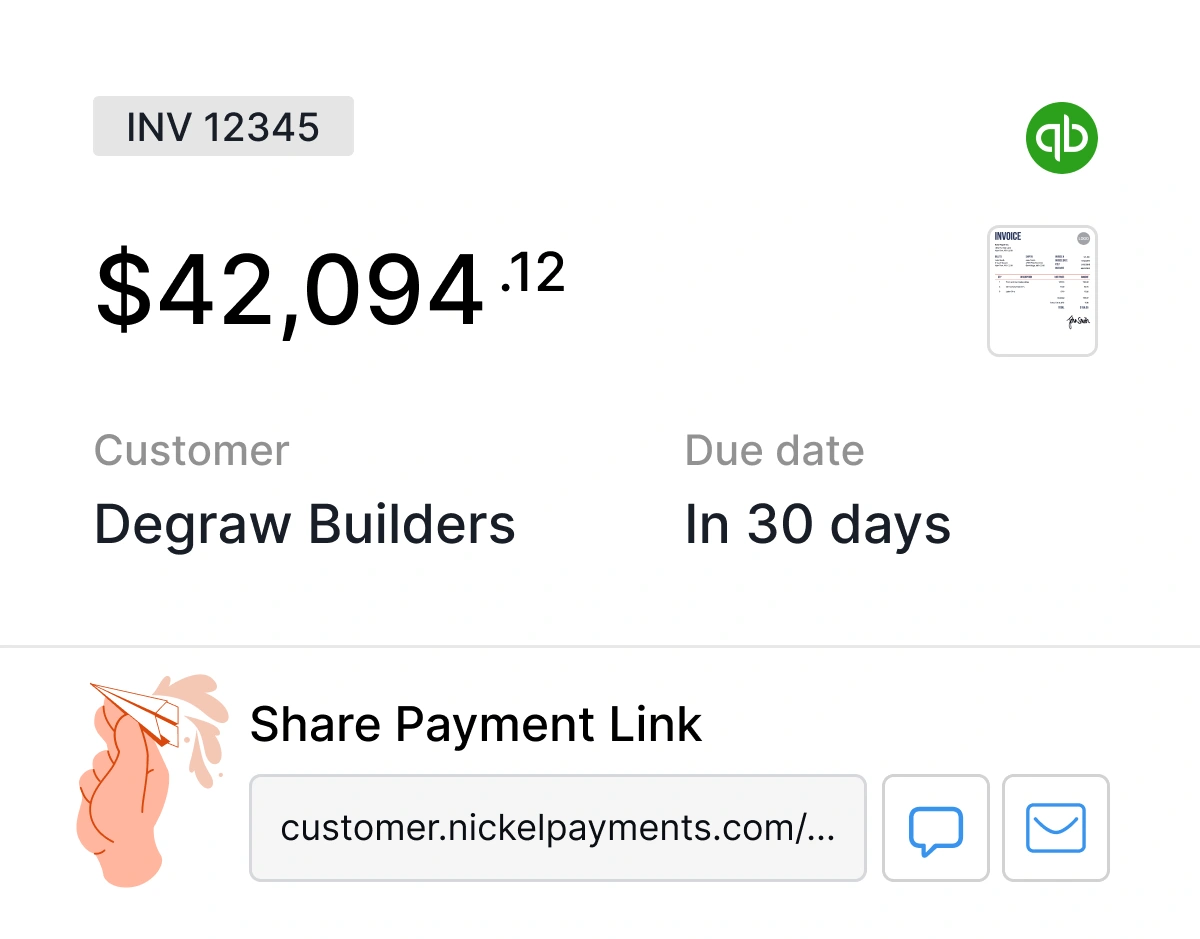

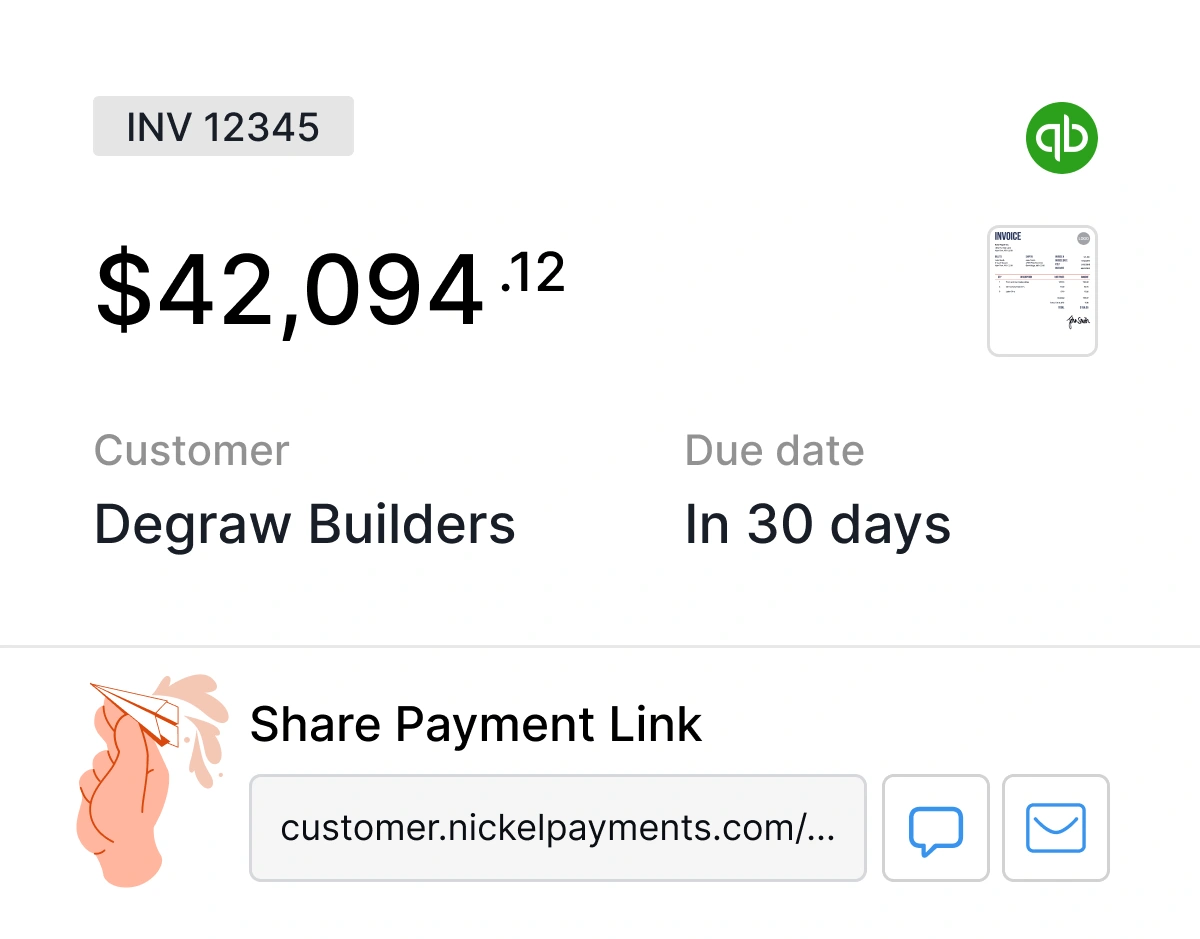

Simplified Modern Workflow

Send invoice (or use your existing invoicing)

Customer pays instantly via secure link

Payment auto-syncs to QuickBooks

Money hits your account in 2 business days

Built-in QuickBooks Integration

Your payments automatically sync to the right invoice, customer, and job. No more:

Compare: Nickel vs. Other Payment Platforms

What This Means for Your Masonry Business

Save Money

Zero ACH fees: Save $6,000-15,000 per year on a typical masonry business No hidden costs: No setup fees, monthly fees, or surprise charges Early payment discounts: Pay and get paid faster, capture supplier discounts

Save Time

Automated reconciliation: 3+ hours per week saved on bookkeeping Instant invoicing: Send payment links directly from job sites One system: Stop switching between payment apps, banking apps, and QuickBooks

Reduce Risk

Process large payments worry-free: We understand masonry transactions and provide responsive support when needed Predictable processing: Money hits your account in 2 business days Secure payments: Bank-level security without the bank headaches

Masonry Industry Payment Breakdown

The U.S. masonry contracting industry generates $32.9 billion in annual revenue, yet cash flow remains the biggest obstacle facing contractors in this traditional trade. Understanding the financial pressures unique to masonry work helps explain why conventional payment processors fail this industry.

Market Fragmentation and Competition:

The masonry industry consists primarily of small, local contractors competing on reputation and relationships. Most masonry businesses employ fewer than 20 workers, creating a fragmented market where individual contractors lack negotiating power with banks and payment processors. During periods of low demand, competition shifts to price-based bidding, further compressing already thin profit margins.

Geographic and Economic Pressures:

Masonry contractors concentrate in regions like the Mid-Atlantic, where robust industrial production and historical building preferences create steady demand. However, this geographic concentration means weather events, economic downturns, or construction slowdowns can impact thousands of contractors simultaneously. New single-family housing construction has been volatile, and while beneficial during booms, it creates feast-or-famine revenue cycles.

Skilled Labor Shortage Crisis:

The masonry industry faces an aging workforce and severe skilled labor shortages, forcing contractors to offer higher wages and benefits to attract and retain qualified masons. With projected growth of only 2% from 2024 to 2034, slower than average job growth means increased competition for skilled workers. These higher labor costs must be absorbed while customer payments remain slow and unpredictable.

Commercial Project Payment Complexity:

Commercial masonry projects typically range from $25,000-100,000+ per job, involving complex contracts with multiple stakeholders. Payment applications must be submitted monthly with detailed documentation, then wait for approval through multiple layers of project management, general contractors, and property owners. Even minor discrepancies can delay payments for weeks, while materials suppliers and payroll obligations continue regardless.

Masonry Industry Payment Breakdown

The U.S. masonry contracting industry generates $32.9 billion in annual revenue, yet cash flow remains the biggest obstacle facing contractors in this traditional trade. Understanding the financial pressures unique to masonry work helps explain why conventional payment processors fail this industry.

Market Fragmentation and Competition:

The masonry industry consists primarily of small, local contractors competing on reputation and relationships. Most masonry businesses employ fewer than 20 workers, creating a fragmented market where individual contractors lack negotiating power with banks and payment processors. During periods of low demand, competition shifts to price-based bidding, further compressing already thin profit margins.

Geographic and Economic Pressures:

Masonry contractors concentrate in regions like the Mid-Atlantic, where robust industrial production and historical building preferences create steady demand. However, this geographic concentration means weather events, economic downturns, or construction slowdowns can impact thousands of contractors simultaneously. New single-family housing construction has been volatile, and while beneficial during booms, it creates feast-or-famine revenue cycles.

Skilled Labor Shortage Crisis:

The masonry industry faces an aging workforce and severe skilled labor shortages, forcing contractors to offer higher wages and benefits to attract and retain qualified masons. With projected growth of only 2% from 2024 to 2034, slower than average job growth means increased competition for skilled workers. These higher labor costs must be absorbed while customer payments remain slow and unpredictable.

Commercial Project Payment Complexity:

Commercial masonry projects typically range from $25,000-100,000+ per job, involving complex contracts with multiple stakeholders. Payment applications must be submitted monthly with detailed documentation, then wait for approval through multiple layers of project management, general contractors, and property owners. Even minor discrepancies can delay payments for weeks, while materials suppliers and payroll obligations continue regardless.

Ranked #1 Easiest to Use Payment Solution by G2

See why Nickel outranks every major competitor, including Forwardly, Melio, and Square

Get Started in Minutes

No contracts. No setup fees. No risk.

Sign Up (2 minutes)

Connect QuickBooks (1 click)

Start Getting Paid (immediately)

Ready to Fix Your Payment Problems?

Stop losing money to fees and time to complicated workflows. Join thousands of contractors who've already made the switch.