The Payment Platform Built for Welders

Power up your cash flow with payments that actually work for metal fabrication professionals

Trusted by 10,000+ industrial small businesses

Why Welders Are Switching to Nickel

Unlike traditional payment processors that treat you like a "high-risk" business, Nickel was built specifically for trade professionals who handle large invoice-based transactions. We understand that:

- $25,000 structural steel fabrication payments are normal business, not suspicious activity

- Custom fabrication projects create payment surges that banks often flag as unusual

- You need reliable processing during peak seasons like construction booms

- Your cash flow depends on predictable payment timing, not arbitrary holds

Result: No surprise account holds, no "business verification" delays, no risk department calls.

Why Welders Are Switching to Nickel

Unlike traditional payment processors that treat you like a "high-risk" business, Nickel was built specifically for trade professionals who handle large invoice-based transactions. We understand that:

- $25,000 structural steel fabrication payments are normal business, not suspicious activity

- Custom fabrication projects create payment surges that banks often flag as unusual

- You need reliable processing during peak seasons like construction booms

- Your cash flow depends on predictable payment timing, not arbitrary holds

Result: No surprise account holds, no "business verification" delays, no risk department calls.

Before Nickel vs. After Nickel

Multiple systems for invoicing, payments, and bookkeeping

Banks freeze accounts over routine $25,000 structural welding payments

Lose 1-3% on every transaction ($250-750 per major fabrication job)

Banks don't understand welding business patterns and variable project values

Hours spent matching payments to invoices in QuickBooks

Everything integrated: invoicing, payments, and QuickBooks sync

We understand large and variable transactions are normal for welders and our support team is highly responsive if you ever run into issues

Keep 100% of what customers pay you

Designed around how your business actually works

Your invoices and payments automatically sync to the right customer, service call, and project, plus seamless AP integration

The Metal Fabrication Payment Reality

The welding industry faces unique financial challenges that generic payment processors simply don't understand. With the welding market valued at $25 billion globally as of 2024 and projected to exceed $34 billion by 2030, welders are caught between rising material costs and clients demanding flexible payment options.

Project-Based Payment Volatility:

Welding work varies dramatically from small repair jobs to massive industrial fabrication projects. A simple fence repair might cost $500, while a commercial building framework can exceed $50,000. Uneven workloads, seasonality, and weather-related work stoppages can all affect your ability to generate income consistently. Traditional banks see these payment spikes as red flags, leading to account freezes right when you need cash flow most.

Material Cost Pressure:

Welding projects often require significant upfront costs, such as materials and labour, which can put a strain on your cash flow. Steel prices fluctuate wildly - sometimes increasing 40-60% in a single year - forcing welders to manage larger upfront costs while waiting longer for payments. When a structural steel project requires $15,000 in materials alone, cash flow timing becomes critical.

Equipment Investment Challenges:

Professional welding equipment represents a massive investment. A quality TIG welder costs $3,000-8,000, while plasma cutting systems can exceed $15,000. The initial purchase of welding equipment can deplete cash reserves, affecting your business's ability to respond to other opportunities or needs. When customer payments are delayed, upgrading or maintaining equipment becomes impossible.

Seasonal Demand Fluctuations:

The welding industry experiences significant seasonal variations. Construction projects cluster in spring and summer months, while winter brings maintenance and repair work. During slow periods, generating enough income to cover your expenses and keep your business afloat can be challenging. This unpredictable income makes it difficult to maintain steady cash flow year-round.

The Metal Fabrication Payment Reality

The welding industry faces unique financial challenges that generic payment processors simply don't understand. With the welding market valued at $25 billion globally as of 2024 and projected to exceed $34 billion by 2030, welders are caught between rising material costs and clients demanding flexible payment options.

Project-Based Payment Volatility:

Welding work varies dramatically from small repair jobs to massive industrial fabrication projects. A simple fence repair might cost $500, while a commercial building framework can exceed $50,000. Uneven workloads, seasonality, and weather-related work stoppages can all affect your ability to generate income consistently. Traditional banks see these payment spikes as red flags, leading to account freezes right when you need cash flow most.

Material Cost Pressure:

Welding projects often require significant upfront costs, such as materials and labour, which can put a strain on your cash flow. Steel prices fluctuate wildly - sometimes increasing 40-60% in a single year - forcing welders to manage larger upfront costs while waiting longer for payments. When a structural steel project requires $15,000 in materials alone, cash flow timing becomes critical.

Equipment Investment Challenges:

Professional welding equipment represents a massive investment. A quality TIG welder costs $3,000-8,000, while plasma cutting systems can exceed $15,000. The initial purchase of welding equipment can deplete cash reserves, affecting your business's ability to respond to other opportunities or needs. When customer payments are delayed, upgrading or maintaining equipment becomes impossible.

Seasonal Demand Fluctuations:

The welding industry experiences significant seasonal variations. Construction projects cluster in spring and summer months, while winter brings maintenance and repair work. During slow periods, generating enough income to cover your expenses and keep your business afloat can be challenging. This unpredictable income makes it difficult to maintain steady cash flow year-round.

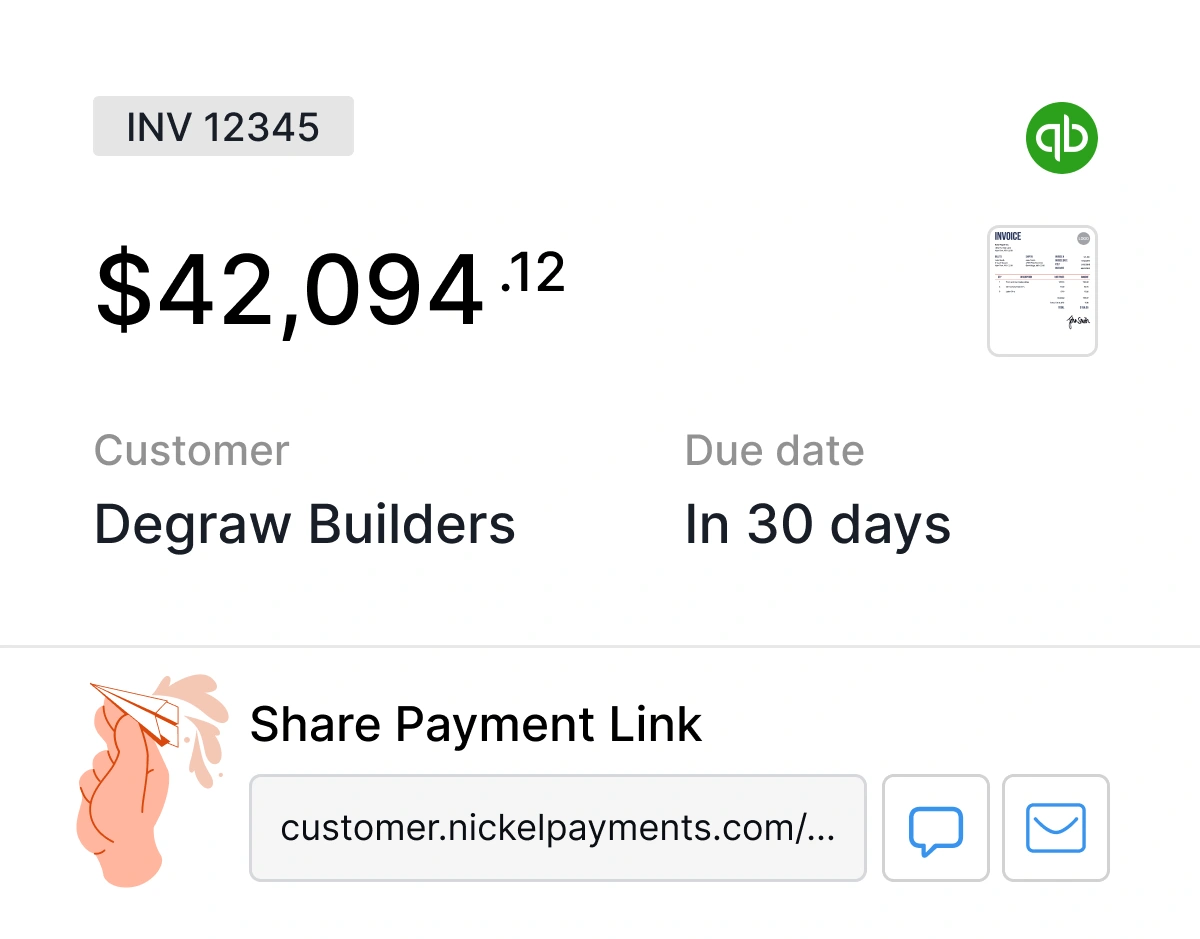

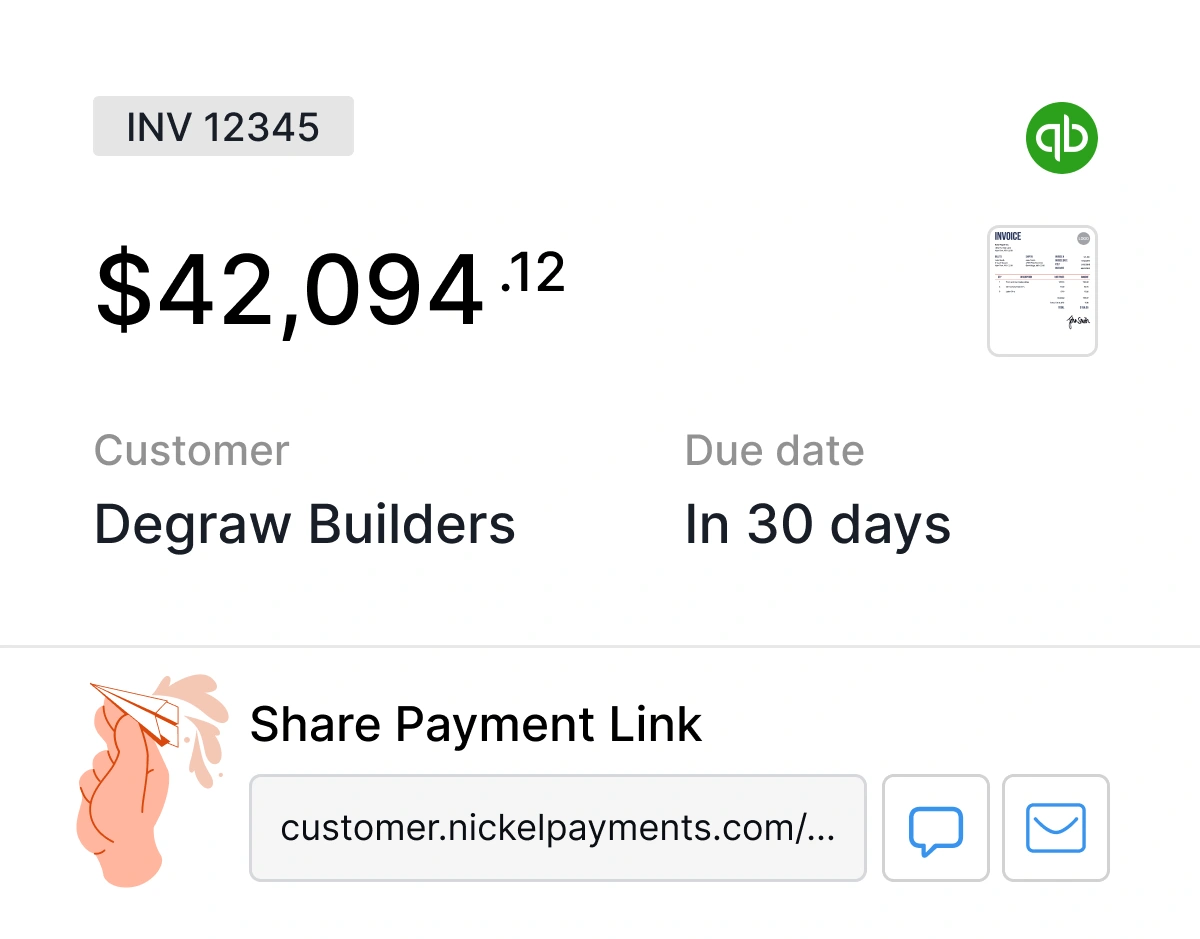

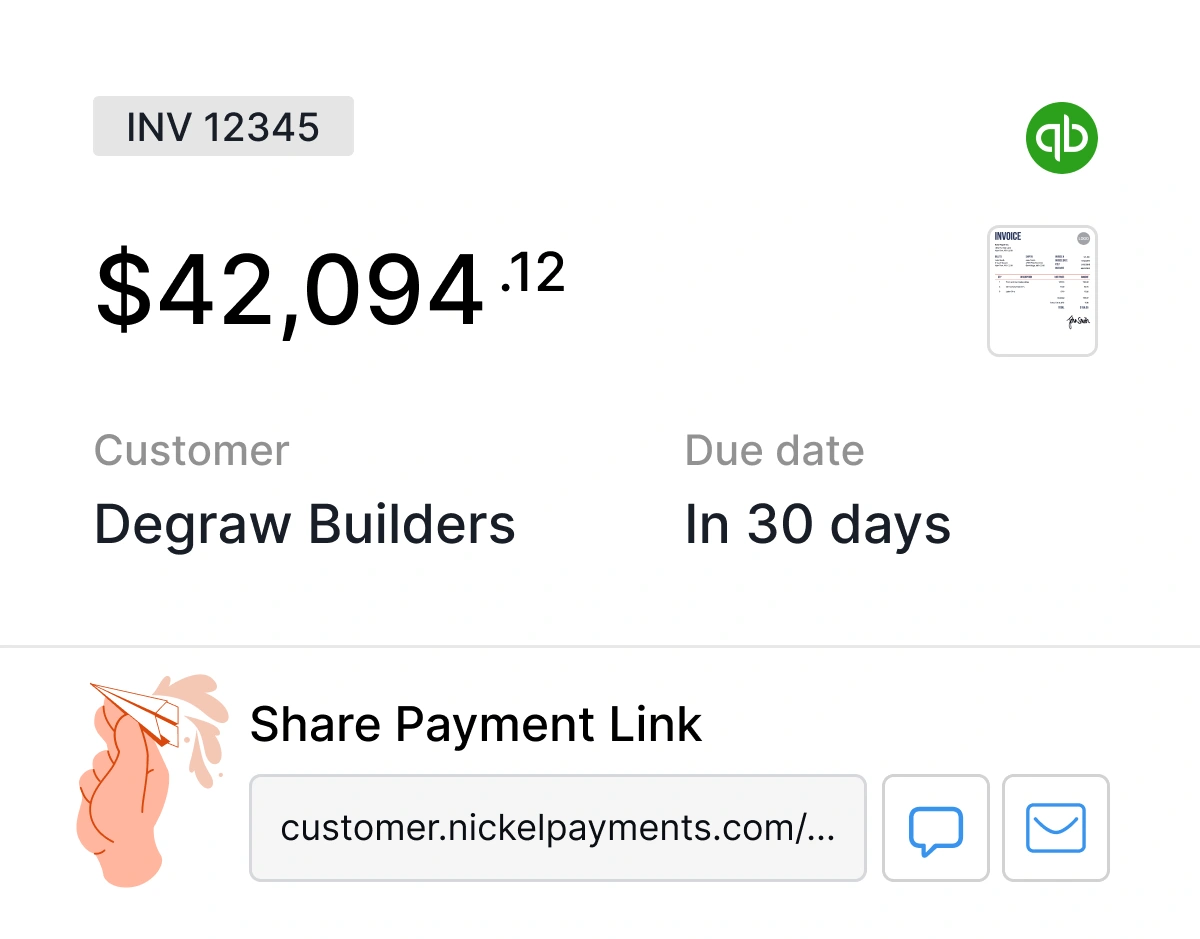

Simplified Modern Workflow

Send invoice (or use your existing invoicing)

Customer pays instantly via secure link

Payment auto-syncs to QuickBooks

Money hits your account in 2 business days

Built-in QuickBooks Integration

Your payments automatically sync to the right invoice, customer, and job. No more:

Compare: Nickel vs. Other Payment Platforms

What This Means for Your Welding Business

Save Money

Zero ACH fees: Save $4,000-12,000 per year on a typical welding business No hidden costs: No setup fees, monthly fees, or surprise charges Early payment discounts: Pay and get paid faster, capture supplier discounts

Save Time

Automated reconciliation: 3+ hours per week saved on bookkeeping Instant invoicing: Send payment links directly from job sites One system: Stop switching between payment apps, banking apps, and QuickBooks

Reduce Risk

Process large payments worry-free: We understand welding transactions and provide responsive support when needed Predictable processing: Money hits your account in 2 business days Secure payments: Bank-level security without the bank headaches

Welding Industry Financial Breakdown

The welding sphere has more than doubled over the last decade, registering a robust 6.2% CAGR from 2017-2023. This massive growth brings unique financial pressures that traditional payment processors weren't designed to handle.

Market Fragmentation:

The welding industry consists primarily of small operations - most welding businesses have fewer than 10 employees but handle projects ranging from $1,000 residential repairs to $100,000+ commercial fabrication jobs. These smaller operations lack the leverage to negotiate better payment terms with banks or processors, often getting stuck with high fees and restrictive policies designed for larger enterprises.

Project Economics:

Welders who are just starting out typically make $15-20 dollars an hour. After a few years on the job, your hourly rate will jump to $20-30 dollars an hour. However, material costs can represent 40-60% of total project costs. When customers pay by credit card, processors typically charge 2.9-3.5% plus transaction fees, eating directly into already competitive margins.

Equipment Financing Challenges:

Financing arrangements can alleviate the immediate financial burden of acquiring welding equipment, spreading the cost over time and allowing businesses to retain capital for other strategic uses. However, traditional financing often doesn't understand the project-based nature of welding work, making it difficult to secure equipment loans that align with cash flow patterns.

Cash Flow Management:

Tracking income and expenses isn't just about balancing your books it's about planning for growth. Proper bookkeeping helps identify profit trends, manage cash flow, and prepare for future investments. When customer payments are delayed, meeting payroll and supplier obligations becomes a constant stress point, especially during slower seasons.

Welding Industry Financial Breakdown

The welding sphere has more than doubled over the last decade, registering a robust 6.2% CAGR from 2017-2023. This massive growth brings unique financial pressures that traditional payment processors weren't designed to handle.

Market Fragmentation:

The welding industry consists primarily of small operations - most welding businesses have fewer than 10 employees but handle projects ranging from $1,000 residential repairs to $100,000+ commercial fabrication jobs. These smaller operations lack the leverage to negotiate better payment terms with banks or processors, often getting stuck with high fees and restrictive policies designed for larger enterprises.

Project Economics:

Welders who are just starting out typically make $15-20 dollars an hour. After a few years on the job, your hourly rate will jump to $20-30 dollars an hour. However, material costs can represent 40-60% of total project costs. When customers pay by credit card, processors typically charge 2.9-3.5% plus transaction fees, eating directly into already competitive margins.

Equipment Financing Challenges:

Financing arrangements can alleviate the immediate financial burden of acquiring welding equipment, spreading the cost over time and allowing businesses to retain capital for other strategic uses. However, traditional financing often doesn't understand the project-based nature of welding work, making it difficult to secure equipment loans that align with cash flow patterns.

Cash Flow Management:

Tracking income and expenses isn't just about balancing your books it's about planning for growth. Proper bookkeeping helps identify profit trends, manage cash flow, and prepare for future investments. When customer payments are delayed, meeting payroll and supplier obligations becomes a constant stress point, especially during slower seasons.

Ranked #1 Easiest to Use Payment Solution by G2

See why Nickel outranks every major competitor, including Forwardly, Melio, and Square

Get Started in Minutes

No contracts. No setup fees. No risk.

Sign Up (2 minutes)

Connect QuickBooks (1 click)

Start Getting Paid (immediately)

Ready to Fix Your Payment Problems?

Stop losing money to fees and time to complicated workflows. Join thousands of contractors who've already made the switch.